NFC Analytical Offseason Grades: Free Agency and Trade Value

Projecting acquired player value for 2024 versus expectations based on contract and trade values

Since the league year officially began a few weeks ago, we’ve seen hundreds of releases, free-agent signings and trades that will substantially alter the results of the 2023 NFL season. Even before free agents were officially able to sign new contracts, deals had been informally announced, and a handful of trades had been agreed to in principle.

I’ve been tracking and estimating the collective effect of all of these moves with the Unexpected Points Improvement Index, deriving a points-based measure of gains and losses for every team versus their rosters at the end of the 2023 season. As of now, the Atlanta Falcons are projected to add the most in point differential this season with the addition of Kirk Cousins, while the Baltimore Ravens having lost the most with a number of their 2023 starters finding new homes. The gains and losses are, obviously, a reflection on the baseline for how good or bad a team was coming into the offseason, and how much free cap space they had to invest. The Ravens have lost a lot because their 2023 roster was so good and productive, falling a little from the highest perch.

Just because teams spent a lot, and improved the most off of a lower base projection, it doesn’t mean the spending was done wisely. In fact, the more you have to spend and the more needs you have, the easier it can be to overspend in free agency, the market where contracts have the highest premiums to player production.

In this analysis, beginning with NFC teams, I’m going to look more into how wisely teams spent their free agent dollar and trade capital the offseason from a cost-benefit standpoint. The cost for each acquisition is the player’s contract APY, with a premium added to account for surplus value lost in the case of players who were acquired via trades. I grabbed the contract values from OverTheCap.com.

You can find more information on how to quantify draft pick values in my previous analysis on draft value curves. For this analysis, I’m excluding quarterback additions, but will comment on them in the blurbs for each division.

The benefit side is my projections for value added over replacement level next season for each acquired player. The projections use players’ previous two years usage and production (NFL Plus/Minus metric) to project out the next year. We could project over multiple seasons and adjust for the length of contract, but realistically most free agent signings only have a substantial positive impact for a single season, and most contracts are structured to allow teams to release players after one year.

Grouping together all of the acquired players this offseason, we can see that there is a strong correlation between contract amounts in annual per year (APY) and my projected points over replacement. The slope of the curve is also less than one, meaning there are diminishing returns for each subsequent dollar spent for individual acquisitions. On average, a $5 million APY signing brings around 6.5 points over replacement, but moving up to $15 million of $20 million APY equates to less than the equivalent points.

A big part of what makes a good free agent signing isn’t the characteristics of the individual players as much as the dynamics of the market by position. As we found in pre-free agency research, certain offensive and defensive positions have stronger talent available in free agency. Those values align with what I labeled as “Tier 3” positions according to my surplus value draft curves: interior offensive line, linebacker, running back, tight end and safety.

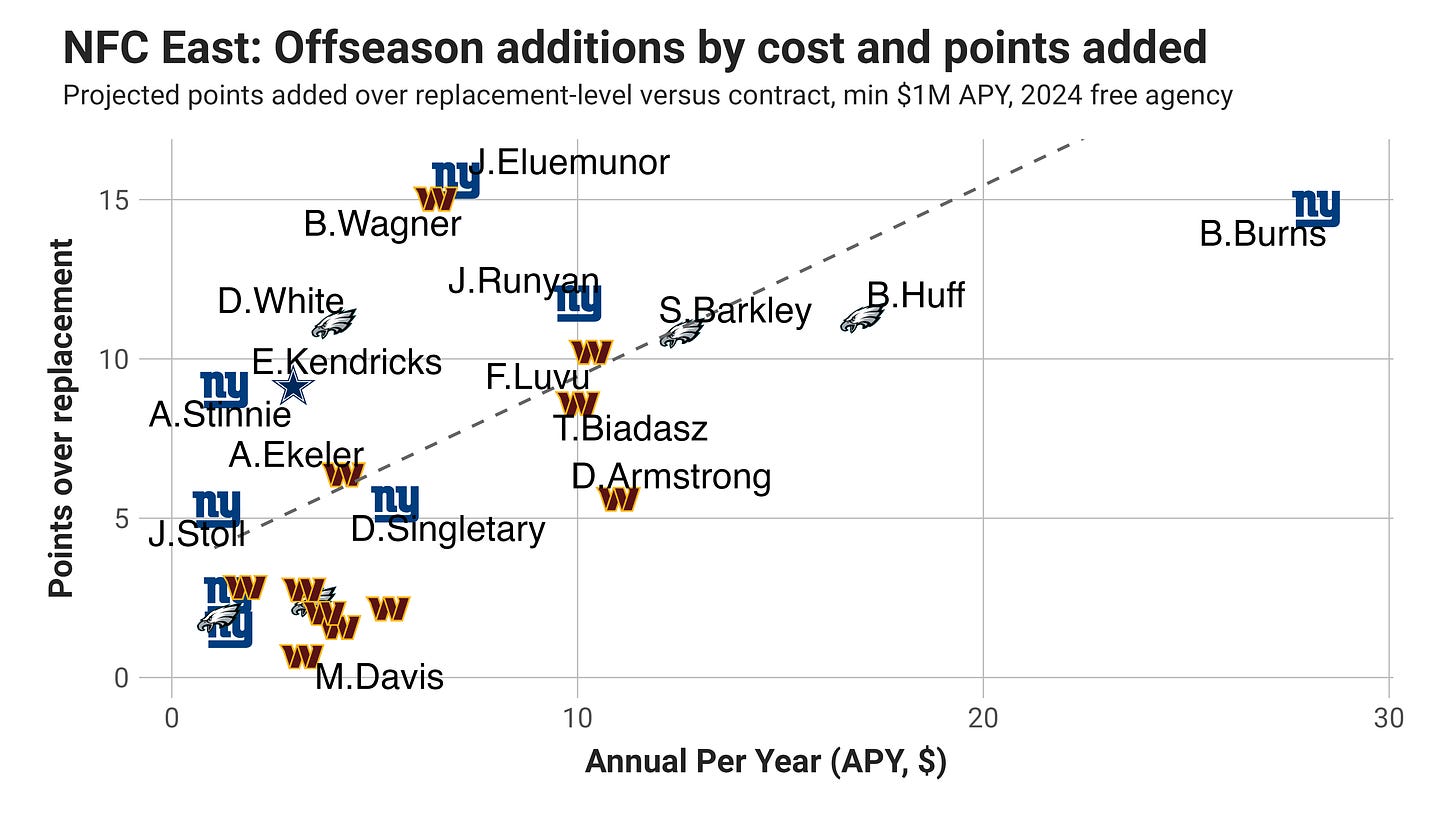

For each NFC division, I’m going to display a plot of every acquired player by APY cost and points over replacement benefit, then aggregate the team totals for those acquisitions by APY spent (Total APY), points over replacement gained (Total +/-), points over/under contract expectation (Vs Exp), the team percentile for points over expectation per dollar spent (Value), and the team’s grade based on a combination of percentiles for total gain/loss and by dollar spent. I divided the percentile spectrum (0-100) to make the grade allocations an even distribution.

Only players with a 2024 APY over at least $1 million are included in the numbers, and a handful of players are missing due to the lack of contract information available at the time this was written.

NFC EAST: EAGLES, COWBOYS, GIANTS & COMMANDERS

I’ll start with the Cowboys, a team that has almost completely sat out of free agency. They get an “A” grade for the value on that one deal, but rather than relying on the model you can lean on the heuristic of “spending in free agency is bad and not spending it good” to give the Cowboys a high mark so far.

The Commanders were relatively big spenders this free-agency period, as bad teams typically have more holes to fill than draft picks, and also have cash on hand with few previously successful draft selections to extend. The Commanders could have used some of that money to extend Montez Sweat, but instead took the second-round pick from the Bears and acquired players other teams didn’t extend, including a few former Cowboys that new head coach Dan Quinn likely coveted. Most of the Commanders signings project poorly in value, outside of getting Bobby Wagner at a modest contract, though even he comes with risk of decline entering his age-34 season.

The Giants were the sixth biggest spenders so far, on the heels of being in the top-5 last offseason. The projections don’t hate the value add overall, though their biggest acquisition in trading for Brian Burns looks underwhelming. The Burns projection is probably too pessimistic, though Burns’ pressure and win rates tracked by PFF put him well outside of the elite tier of rushers the last two seasons.

The Eagles were bigger spenders this year after mostly bleeding talent last offseason. Overall, the value at which they acquired bigger signings like Bryce Huff and Saquon Barkley projects poorly. Being a net spender in free agency means that the Eagles will likely not be awarded any compensatory picks in the 2025 draft, aftering getting an extra four picks this offseason based on losing players a year ago.

NFC WEST: 49ERS, SEAHAWKS, RAMS & CARDINALS

Keep reading with a 7-day free trial

Subscribe to Unexpected Points to keep reading this post and get 7 days of free access to the full post archives.